This material may not be published, broadcast, rewritten, or redistributed.

#Freddie mac interest rates today free#

You can use Credible's free online tool to easily compare multiple mortgage refinance lenders and see prequalified rates in as little as three minutes. If you think refinancing is the right move, consider using Credible. You can compare quotes from top-rated insurance carriers in your area - it's fast, easy and the whole process can be completed entirely online. If you're looking for a better rate on home insurance and are considering switching providers, consider using an online broker. When you apply for a loan, you’ll usually be able to find the interest rate on the first page of your loan estimate, and the APR later in the document listed under "comparisons."Ĭredible is also partnered with a home insurance broker. For a mortgage or refinance, those costs can include discount points, fees and other charges. Generally, APR gives you a better picture of the true cost of a loan since it takes into account all the costs associated with borrowing money. Annual percentage rate, or APR, encompasses the interest rate and other fees and charges attached to your loan. The interest rate is the cost the lender will charge annually to loan you money. When you’re shopping for a mortgage or refinance loan, you’ll see the terms APR and interest rate arise often. The rate you receive can vary based on a number of factors.

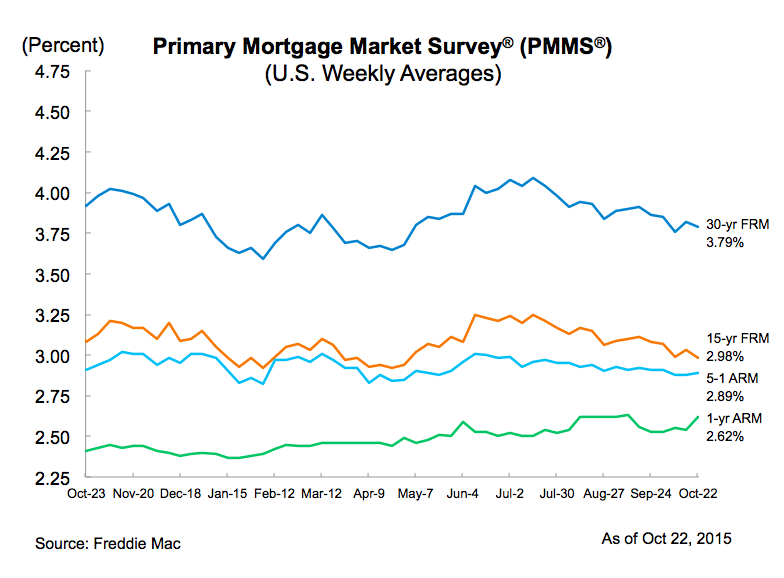

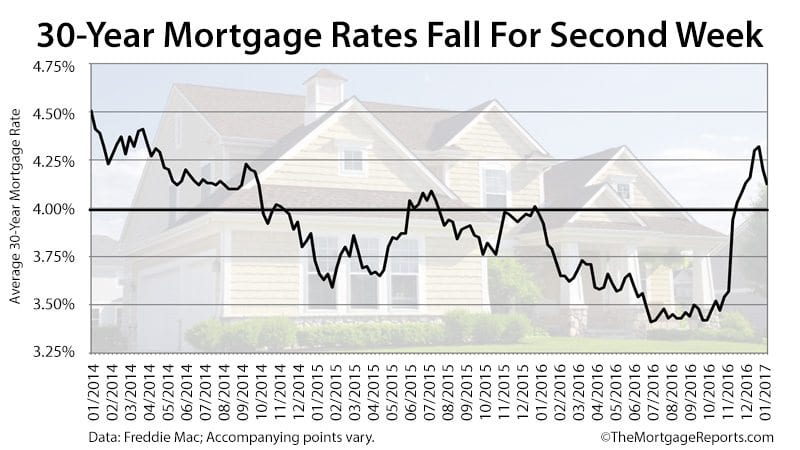

The rates also assume no (or very low) discount points and a down payment of 20%.Ĭredible mortgage refinance rates will only give you an idea of current average rates. The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. Credible average mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible. How does Credible calculate refinance rates?Ĭhanging economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage refinance rates. You can do this easily with Credible’s free online tool and see your prequalified rates in only three minutes. It’s also a good idea to compare rates from different lenders if you're hoping to refinance so you can find the best rate for your situation.īorrowers can save $1,500 on average over the life of their loan by shopping for just one additional rate quote, and an average of $3,000 by comparing five rate quotes, according to research from Freddie Mac.īe sure to shop around and compare rates from multiple mortgage lenders if you decide to refinance your mortgage. If you’re interested in refinancing your mortgage, improving your credit score and paying down any other debt could secure you a lower rate.

#Freddie mac interest rates today how to#

How to get your lowest mortgage refinance rate Lenders who market "no-cost loans" typically charge a higher interest rate and roll the costs into the loan - which means you’ll pay more interest over the life of the loan. Keep in mind there’s no such thing as a truly no-cost refinance. Lender fees, such as origination or underwriting.The cost of recording your new mortgage.Your exact refinancing costs will depend on multiple factors, including the size of your loan and where you live. Generally, you’ll encounter costs - $5,000 on average, according to Freddie Mac - when refinancing your mortgage. But all those savings don’t come for free. Refinancing a mortgage can yield significant interest savings over the life of a loan. These rates are based on the assumptions shown here. Check out Credible and get prequalified today. You can explore your mortgage refinance options in minutes by visiting Credible to compare rates and lenders. But you could also end up with a bigger monthly mortgage payment. A 10-year refinance will help you pay off your mortgage sooner and maximize your interest savings. The current rate for a 10-year fixed-rate refinance is 2.875%. A 15-year refinance could be a good choice for homeowners looking to strike a balance between lowering interest costs and retaining a manageable monthly payment. The current rate for a 15-year fixed-rate refinance is 2.875%. But you may get a higher monthly payment. By refinancing a 30-year loan into a 20-year refinance, you could secure a lower interest rate and reduce total interest costs over the life of your mortgage. The current rate for a 20-year fixed-rate refinance is 3.250%.

Refinancing a shorter term mortgage into a 30-year refinance could result in a lower monthly payment but higher total interest costs. Refinancing a 30-year mortgage into a new 30-year mortgage could lower your interest rate, but may not have much effect on your total interest costs or monthly payment. The current rate for a 30-year fixed-rate refinance is 3.625%.

0 kommentar(er)

0 kommentar(er)